north dakota sales tax registration

E-mail support from our knowledgeable staff. Avoid costly fines and penalties and get ongoing tax support.

How To Register For A Sales Tax Permit In North Dakota Taxvalet

Office hours are Monday through Friday 8 am.

. However this does not include any potential local or county taxes. The cumulative North Dakota sales tax percentage is between 5 and 7. Tax savings begin day one.

If you have questions about the sales tax permit the North Dakota Office of State Tax Commissioner has a guide to sales taxes in North Dakota or can be contacted by calling. Manage your North Dakota business tax accounts with Taxpayer Access point TAP. Fast Secure - Florida State Sales Use Tax Application - Nd State Taxes North Dakota.

Registering Your Business Name. Registered users will be able to file. Ad Business formation for ongoing tax success.

Ad Offload the tedius tasks of registering in mulitple jurisdictions to Avalara. NORTH DAKOTA SALES TAX 5 County Tax - Yes Personal Property Tax No 701 328-7088 or 877 328-7088 REGISTRATIONS Documented Boats are Not Required. If you currently have or plan to have employees performing services within North Dakota you should read the Income Tax Withholding Guideline.

Registration period is from January 1 2020 through December 31 2022. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the first quarter of. Sales and Use Tax Registration Registration Who Should Register and File.

In addition to taxes car purchases in North Dakota may be subject to other fees like registration title and. Copyright 2022 North Dakota Office of State Tax Commissioner. The sales tax on a car purchased in North Dakota is 5.

North Dakota Taxpayer Access Point. Ad New State Sales Tax Registration Application Exemption. Fill out one form choose the states you sell to and let us do the heavy lifting.

Motorboats under 16 feet in length and all canoes regardless of length powered by a. Get the recommendation of a CPA today. The Secretary of States web site provides.

Ad New State Sales Tax Registration Application Exemption. NORTH DAKOTA SALES TAX 5 County Tax - Yes Personal Property Tax No 701 328-7088 or 877 328-7088 REGISTRATIONS Documented Boats are Not Required to Be. Fill out one form choose the states you sell to and let us do the heavy lifting.

Welcome To The New Business Registration Web Site. Simplified and streamlined application forms. No Fee in NC to Apply for a Certificate of Registration Register Online Register by Mail Other Information.

Apply online at the North Dakota Taxpayer Access Point TAP. North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office of State Tax Commissioner to all sales tax permit holders. 127 Bismarck ND 58505-0599 Main Number.

TAP allows North Dakota business taxpayers to electronically. Get Privacy by Default lifetime support from our Corporate Guides doc scans and more. Thank you for selecting the State of North Dakota as the home for your new business.

Thursday June 23 2022 - 0900 am. The topics addressed within this site will. Ad Offload the tedius tasks of registering in mulitple jurisdictions to Avalara.

Please schedule an appointment to visit with staff in our field offices. With the exception of state holidays. Ad Our streamlined application ensures we only collect the information we need once.

After reading the guidelines complete the. The average local tax rate in North Dakota is. Business structures range from informal sole proprietorships to complex corporations with publicly traded stock.

Ad When you want more from your registered agent service hire Northwest Registered Agent. Mailing Address Office of. Fast Secure - Florida State Sales Use Tax Application - Nd State Taxes North Dakota.

According to the North Dakota Office of State Tax Commissioner the N o rth Dakota state sales tax rate is 5. This is a sales and use tax exemption for building materials equipment and other tangible personal property used to expand or construct an oil refinery in North Dakota. North Dakota collects a 5 state sales tax rate on the purchase of all vehicles.

Or file by mail using the North Dakota Application for Income Tax Withholding and Sales and Use Tax.

North Dakota Dba Nd Trade Name Registration Truic

Tax Compliance For Startups And Small Business Nd Women S Business Center

North Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

4 Reasons A Transaction May Be Exempt From South Dakota Sales Tax South Dakota Department Of Revenue

North Dakota Office Of State Tax Commissioner Bismarck Nd Facebook

How To Register For A Sales Tax Permit In North Dakota Taxjar

How To Get A North Dakota Sales Amp Use Tax Permit North Dakota Sales Tax Handbook

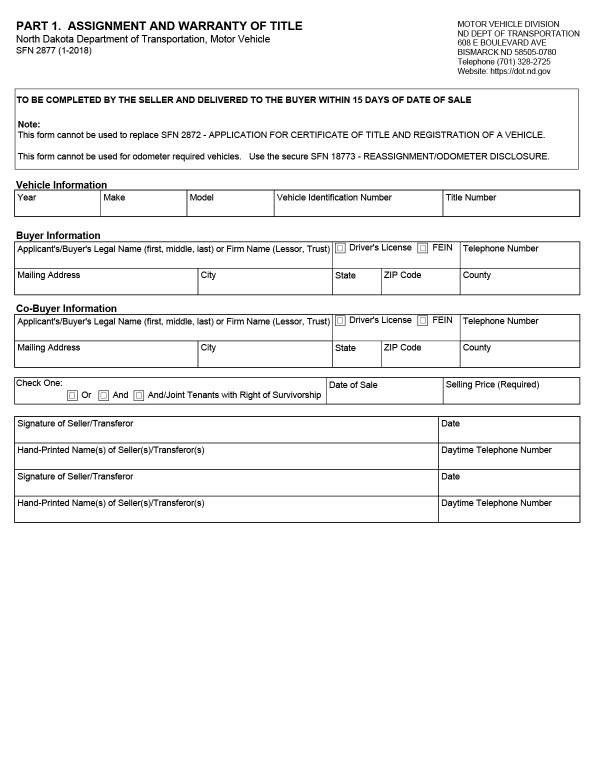

Free North Dakota Boat Vessel Bill Of Sale Form Pdf

Free Form 21919 Application For Sales Tax Exemption Certificate Free Legal Forms Laws Com

How To File And Pay Sales Tax In North Dakota Taxvalet

How To Register For A Sales Tax Permit In South Dakota Taxvalet

South Dakota Department Of Revenue Facebook

How To Register Amazon Fba Sales Tax Permit

About Bills Of Sale In North Dakota What You Need To Know

What Is Sales Tax A Complete Guide Taxjar

How To Start A Business In North Dakota A How To Start An Llc Small Business Guide